Cost-plus pricing is a game-changer for businesses seeking profitability.

Imagine setting prices that guarantee profits while maintaining transparency.

This effective pricing method combines simplicity with strategic thinking, allowing you to cover costs and achieve desired margins.

Discover how cost-plus pricing advantages can transform your business strategy and boost your bottom line.

Ready to master this powerful pricing technique?

Key Takeaways:

- Cost-plus pricing calculates selling price by adding a markup to total costs.

- Advantages include simplicity, transparency, and ensured profitability.

- Disadvantages involve ignoring market conditions and lack of flexibility.

- Ideal for businesses with stable costs, limited competition, or specialized products.

- Regular review and adjustment of pricing strategy is crucial for long-term success.

Simply put, it involves calculating the total cost of production or service delivery, including labor costs, and adding a markup according to the cost-plus pricing formula to establish the final selling price.

The basic formula for cost-plus pricing is Cost + Markup = Selling Price.

This formula, while straightforward, illustrates why pricing adds another layer to strategic planning in pricing the right approach.

Contents

ToggleThe Significance of Pricing Strategy in Business

Pricing is a critical factor in the success of any business, and adopting the right pricing strategy, such as cost-plus pricing, is key to that success.

It directly influences profitability, competitiveness, and overall market positioning through strategic application of the pricing formula.

By setting the right prices for your products or services, you can not only maximize profits but also attract customers and outperform your competitors with a well-thought-out pricing decision model.

Achieving this often involves using cost-plus pricing as part of a broader, more nuanced pricing strategy.

- Profitability: Pricing directly impacts your bottom line. Setting prices too low may lead to reduced profits, while pricing too high could deter customers. Finding the right balance through cost-plus pricing, also referred to as the cost-plus model, ensures that you cover your costs including overhead costs, and generate a healthy profit margin.

- Competitiveness: In a competitive market, pricing can be a key differentiator. By strategically pricing your offerings, you can stand out from competitors, attract customers, and build a loyal customer base. Cost-plus pricing helps you set prices that are both competitive and profitable by accurately covering unit costs and desired rate of return, embodying a fundamental approach to understanding cost-plus pricing.

Understanding Cost-Plus Pricing

In the realm of business, pricing strategies, like cost-plus pricing and value-based pricing, are pivotal in determining profitability and market positioning.

Cost-plus pricing, a strategy gaining popularity among entrepreneurs, involves setting the selling price of a product by adding a markup to the total production cost, serving as a cost-plus pricing example of how businesses ensure their products are priced for profitability.

This markup encompasses both direct costs (materials, labor) and indirect costs (overhead, administrative expenses), along with a desired profit margin, showcasing a cost-plus pricing example that highlights the comprehensive nature of this pricing strategy.

What is Cost-Plus Pricing?

Cost-plus pricing is a straightforward approach where a company determines the selling price of a product by adding a markup to the total cost of production.

Set Profit Margin: Decide on the desired profit margin as a percentage of the total cost, a critical step in the cost-plus pricing method.

Components of Cost-Plus Pricing

- Direct Costs:

- Materials: The cost of raw materials used in production.

- Labor: The expenses incurred for the workforce involved in manufacturing are a significant component of the determined cost-plus pricing calculation.

- Indirect Costs: This includes variable costs that change with production levels and fixed costs that remain constant, which are both crucial components in calculating the cost to produce using the cost-plus method.

- Overhead: Indirect expenses such as utilities, rent, and maintenance are crucial in the calculation of a selling price using a cost-plus pricing formula, ensuring that all factors contributing to the cost of making a product are accounted for.

- Administrative Expenses: Costs related to management and administration.

Types of Cost-Plus Pricing

- Percentage of Cost Pricing: In this method, a certain percentage of the total production cost is added as a markup.

- Fixed Markup Pricing: A predetermined fixed amount is added to the total cost to arrive at the selling price.

How Cost-Plus Pricing Works

Calculating the cost-plus price involves a simple formula:

[Cost-Plus Price = Total Cost + (Total Cost x Markup Percentage)]

This equation underlines the simplicity and logic behind using cost-plus pricing, yet businesses use other methods too, recognizing the value of customer perception.

Step-by-Step Guide on Calculating Cost-Plus Price

- Determine Total Cost: Add up all direct and indirect costs incurred in production, often using cost-plus pricing to determine the final price.

- Accuracy: Pricing software eliminates manual errors in cost calculations, ensuring consistency in pricing decisions, and is a vital tool in applying cost-plus pricing.

- Calculate Markup: Multiply the total cost by the markup percentage.

- Add Markup to Total Cost: Sum up the total cost and the markup to get the cost-plus price.

Example Calculation with Real Numbers

Let’s consider a product with a total cost of $500 and a 30% profit margin:

- Determine the markup by multiplying the total cost by the profit margin: $500 * 0.30 = $150

- Add the markup to the total unit cost to get the cost-plus price: $500 in labor costs + $150 in materials = $650

Factors Affecting Markup Percentage

Several factors influence the markup percentage in Cost-Plus Pricing, including overhead costs and the consistent rate of return desired.

This ensures that pricing for a pair or a unit of product is consistent with business goals.

- Industry Standards: Different industries have varying norms for profit margins. These norms can impact how businesses use cost-plus pricing or other strategies to steer toward industry benchmarks.

- Market Conditions: Supply, demand, and competition in the market can impact the pricing strategy, making the adoption of a simple pricing or freemium pricing model an attractive choice for some businesses. These factors often suggest that cost-plus pricing doesn’t always offer the flexibility needed to adapt to changing market conditions.

Advantages of Cost-Plus Pricing

When it comes to setting prices for your products or services, cost-plus pricing can offer several advantages that can benefit your business in the long run.

Let’s dive into some of the key benefits of using this pricing strategy.

Discussing both the benefits and disadvantages of cost-plus pricing offers a balanced understanding of its application, underlining that cost-plus pricing adds another dimension to pricing strategy debates.

1. Simplicity and Transparency

One of the primary advantages of cost-plus pricing is its simplicity and transparency, making it easier for both you and your customers to understand the pricing structure.

Here’s how it can benefit your business: by implementing cost-plus pricing, also known as markup pricing, you can ensure a stable profit margin against cost fluctuations, making it a simple pricing strategy that provides financial stability.

- Ease of Calculation: With cost-plus pricing, calculating the selling price is straightforward using the cost-plus pricing formula, ensuring that the final price covers both the cost of making the product and a predetermined profit margin. You simply add a markup percentage to the cost of production, making it easy to determine the final price, an example of transparent pricing in action.

- Simplified Pricing Process: This pricing method simplifies the pricing process, eliminating the need for complex pricing strategies or extensive market research.

- Transparency for Customers: Cost-plus pricing, also known as markup pricing, provides transparency to customers by clearly showing how the price is determined by the cost to make, which can help build trust and loyalty.

- Clear Pricing Structure: Customers appreciate a clear and consistent pricing structure, which cost-plus pricing can provide, leading to enhanced customer trust.

2. Ensured Profitability

Another significant advantage of cost-plus pricing is the assurance of profitability for your business.

Let’s explore how the cost-plus pricing strategy, also known as markup pricing, can help ensure consistent profits and sustainable growth.

- Guaranteed Profit Margin: By adding a markup to the cost of production, you ensure that each sale generates a profit, providing a guaranteed profit margin for your business.

- Consistent Profit with Each Sale: Cost-plus pricing helps maintain a consistent profit margin with every sale, giving you a reliable revenue stream.

- Buffer against Cost Fluctuations: This pricing strategy, using the cost-plus model, acts as a buffer against cost fluctuations, ensuring that your profit margins remain stable even when production costs vary.

- Sustainable Business Growth: With a reliable pricing structure in place, your business can experience sustainable growth by maintaining consistent profitability over time.

Disadvantages of Cost-Plus Pricing

When it comes to setting prices for your products or services, cost-plus pricing, although a common method, may not always be the most advantageous strategy.

Let’s delve into some of the drawbacks associated with this pricing approach, including its neglect of dynamic pricing and alternative pricing strategies.

1. Ignoring Market Conditions

One of the significant pitfalls of cost-plus pricing is the tendency to overlook market conditions, emphasizing why a hybrid approach that considers market demand along with cost-plus pricing would require careful calibration.

By solely basing prices on production costs without considering external factors, businesses run the risk of:

- Potential Overpricing or Underpricing: Failing to align prices with what customers are willing to pay can lead to overpriced offerings that deter buyers or underpriced products that leave money on the table.

- Lack of Competitiveness: In a competitive market, pricing too high based on traditional cost-plus pricing without considering value-based pricing can drive customers to rival companies offering better value for money.

- Risk of Losing Customers: Customers are quick to switch to competitors offering more attractive pricing, such as penetration pricing or freemium pricing, resulting in a loss of market share.

2. Inflexibility

Another drawback of the cost-plus pricing method is its inherent inflexibility, making it challenging for businesses to adapt to changing market dynamics without considering additional pricing strategies like penetration pricing.

This rigidity manifests in various ways:

- Resistance to Market Changes: Businesses following a cost-plus approach may resist altering prices even when market conditions dictate otherwise.

- Slow Adaptation to Market Trends: With prices tied to production costs, businesses may struggle to respond promptly to emerging trends or shifts in consumer preferences.

- Difficulty in Launching New Products: Introducing new products at competitive prices becomes cumbersome when constrained by a cost-plus pricing strategy, often requiring a different pricing strategy for adaptability.

- Examples of Industries Affected: Industries such as tech startups and the fashion industry are particularly susceptible to the limitations of this pricing but can benefit from exploring alternative pricing methods such as freemium pricing to stimulate growth and adaptability. In these fast-paced sectors, staying ahead of trends and swiftly adjusting pricing strategies is crucial for remaining competitive and meeting consumer demand.

When to Use Cost-Plus Pricing: Ideal Scenarios

Stable and Predictable Costs

In the realm of business, stability is a cornerstone. When your costs are consistent and easy to predict, cost-plus pricing can be an invaluable tool, especially for determining the pricing of a product by using a pricing formula that accurately reflects the cost of making the product.

Industries like manufacturing, where costs typically remain steady over time, are prime candidates for this pricing approach. With a clear understanding of your expenses, you can confidently add a markup and establish a price that guarantees profitability.

Limited Competition

Imagine being in a niche market with only a few competitors. In such a scenario, using a cost-plus pricing method can be a game-changer by ensuring competitive yet profitable pricing, but it may require a different pricing strategy to address market dynamics effectively.

With fewer players in the field, you gain more control over pricing decisions, allowing for a more consistent rate of return using the cost-plus pricing model, which can be a better price strategy in less competitive markets.

Leveraging cost-plus pricing enables you to set a competitive yet profitable price point that distinguishes you from the competition.

Custom or Specialized Products

Do you offer unique, one-of-a-kind products that demand a deep comprehension of their cost structures and how the cost-plus pricing model, a method for transparent pricing, can be applied?

If so, using the pricing formula is your ticket to success, offering a strategy for your business that combines effectiveness with transparent pricing.

Whether you specialize in crafting bespoke furniture or designing personalized software solutions, having a comprehensive grasp of your production costs is vital for establishing a pricing decision model that ensures profitability.

Cost-plus pricing empowers you to consider all expenses, from materials to labor, and incorporate a markup that reflects the value of your specialized offerings, embodying a principle where pricing is a pricing strategy that carefully balances costs with market acceptability.

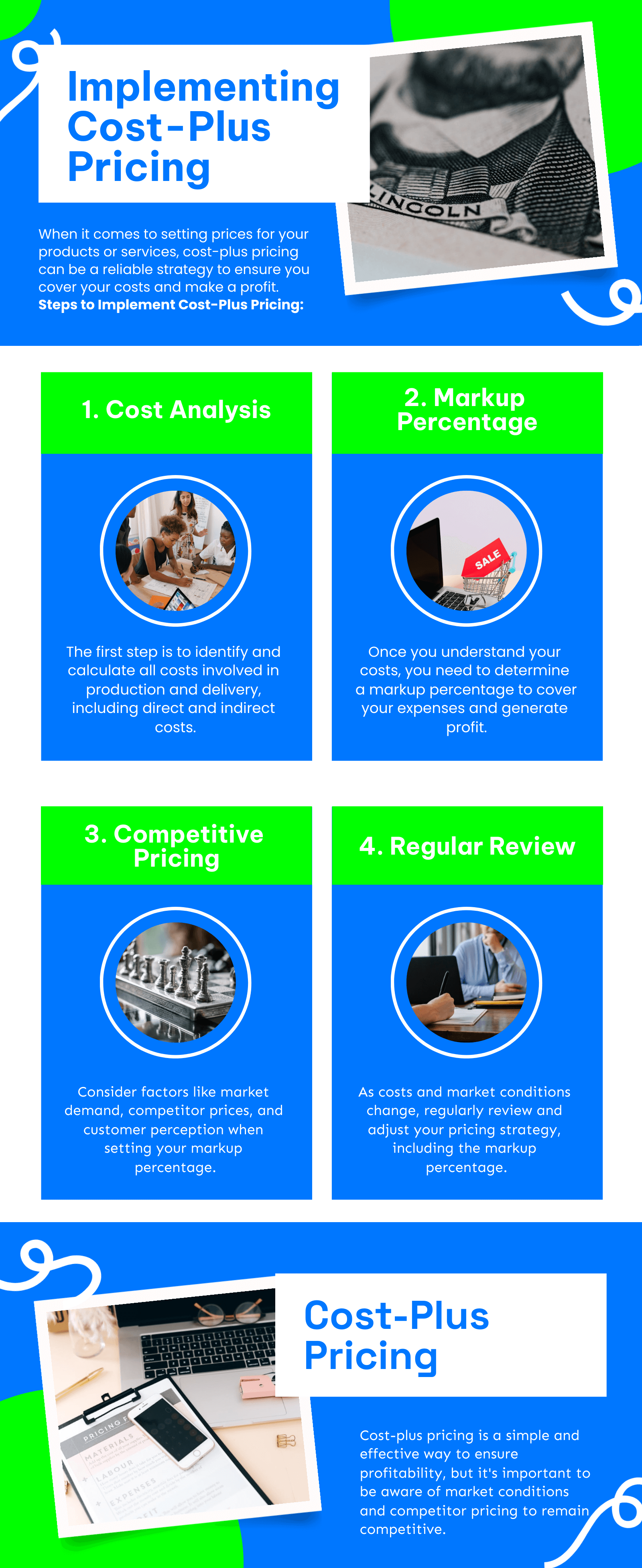

Implementing Cost-Plus Pricing Effectively

When it comes to setting prices for your products or services, cost-plus pricing can be a reliable strategy to ensure you cover your costs and make a profit.

This markup includes both the direct costs (materials, labor) and indirect costs (overhead, administrative expenses), along with a desired profit margin, according to the cost-plus pricing formula, which is a fundamental component of the pricing decision model.

Steps to Implement Cost-Plus Pricing

- Cost Analysis: Before determining the right price for your offerings, it’s crucial to understand all costs involved in producing and delivering them, forming the basis to use the cost-plus pricing formula. This includes direct costs like materials and labor, as well as indirect costs such as overhead expenses.

- Identifying and Calculating All Costs: Create a comprehensive list of all costs associated with your products or services. This includes variable costs that change with production levels and fixed costs that remain constant.

- Determining Markup Percentage: Once you have a clear picture of your costs, including the cost of goods sold, decide on a suitable markup percentage that covers expenses and generates a profit; this is central to using the cost-plus pricing formula effectively. The markup percentage is added to the cost price to arrive at the selling price.

- Setting a Competitive Yet Profitable Margin: Consider market demand, competitor pricing, and customer perception when setting your markup percentage. Striking a balance between competitiveness and profitability is essential, especially when implementing this pricing strategy or alternative pricing strategies like keystone pricing.

- Regular Review and Adjustment: Costs, labor costs, and market conditions can fluctuate, so it’s crucial to regularly review your pricing strategy, including the cost-plus pricing formula, and make adjustments as needed. Periodic cost analysis, including labor costs, overhead costs, and market research, can help you stay competitive with an effective pricing model.

Tools and Software

- Pricing Software Solutions: Invest in pricing software like PriceEdge and Vendavo to streamline the cost-plus pricing process and incorporate dynamic pricing strategies. These tools offer automated cost calculations and real-time pricing analytics to optimize your pricing strategy, making them indispensable for implementing effective pricing strategies.

- Automated Cost Calculations: Pricing software automates cost and markup percentage calculations, saving time and reducing errors, embodying the principle that cost-plus pricing is a pricing method that’s easy to implement with technology. Analyzing pricing data helps make informed decisions to maximize profitability.

Benefits of Using Software for Accuracy and Efficiency

- Accuracy: Pricing software eliminates manual errors in cost calculations, ensuring consistency in pricing decisions.

- Efficiency: Automated tools save time on repetitive tasks, allowing focus on strategic pricing initiatives, especially when implementing a cost-plus pricing strategy, where accuracy in calculating cost and applying markups is vital.

- Competitiveness: Leveraging pricing software helps stay ahead of competitors and adapt quickly to market changes, which is essential when using this pricing strategy to maintain a competitive edge.

Debunking Common Misconceptions About Cost-Plus Pricing

Misconception 1: It Guarantees Profitability

One prevalent misconception about cost-plus pricing is that it guarantees profitability, which can lead to overlooking the need for effective pricing strategies that adapt to market changes, such as freemium pricing or value-based pricing.

However, it’s crucial to understand that this isn’t always a surefire path to profit, as it overlooks other factors like market demand and competitor prices.

However, this is not always the case. While cost-plus pricing involves calculating the total cost of producing a product or service and adding a markup to determine the selling price, it overlooks crucial factors like market demand and competition.

Thus, setting prices based solely on costs may not always lead to optimal profitability, suggesting pricing can be a good approach when complemented with other strategies.

This illustrates why a successful cost-plus pricing strategy must sometimes be complemented with other considerations, like value-based pricing.

Why it’s not always the case:

- Cost-plus pricing may neglect customer willingness to pay and competitor pricing strategies, indicating that while it’s a reliable method for covering costs, pricing doesn’t always align with market expectations or competitive pricing models.

- Solely focusing on costs, such as labor costs, can lead to overpricing of products, if not adjusted by a realistic formula, resulting in lower sales volume. This affirms that cost-plus pricing focuses solely on costs. This situation underscores the disadvantages of this pricing strategy when not carefully implemented.

- In dynamic markets, pricing based only on costs may not reflect the true value of a product or service.

Misconception 2: It’s Only for Large Businesses

Another misconception surrounding the cost-plus model is that it’s exclusively suitable for large businesses with complex cost structures, ignoring that smaller businesses often use it too.

However, small businesses can also use a cost-plus approach effectively for simpler cost structures.

In reality, businesses of all sizes, including small and medium-sized enterprises, can effectively apply cost-plus pricing.

Applicability to small and medium-sized enterprises: Even these entities can benefit from using cost-plus pricing as part of a successful pricing strategy, balancing it with market demands.

- Cost-plus pricing offers a straightforward method for setting prices, making it accessible to businesses with limited resources for pricing analysis. This pricing method is easy to implement and helps in simplifying the pricing process.

- Small businesses can utilize cost-plus pricing as a starting point and adjust prices based on market feedback and competition.

- By understanding their costs to make, overhead costs, and adding a reasonable markup, small and medium-sized enterprises can ensure they cover expenses and generate a profit.

People Also Asked

1. What is the primary benefit of cost-plus pricing?

The primary advantage of cost-plus pricing is its simplicity and transparency. By basing the selling price on production costs and a predetermined markup, businesses can easily communicate their pricing strategy to customers and stakeholders.

This straightforward approach helps build trust and credibility with consumers, leading to increased customer loyalty and satisfaction.

2. How do I determine the right markup percentage for my business?

Calculating the ideal markup percentage for your business involves considering various factors such as industry standards, competition, and target profit margins, ensuring that the cost-plus pricing strategy is appropriately applied.

While there is no one-size-fits-all formula for determining the right markup, a common approach is to analyze market trends, production costs, and pricing strategies of competitors to establish a competitive yet profitable markup percentage.

3. Can cost-plus pricing be used in highly competitive markets?

Despite its simplicity, cost-plus pricing can be effectively utilized in highly competitive markets. By accurately estimating production costs and strategically setting markup percentages, businesses can maintain profitability while remaining competitive.

This is a hallmark of cost-plus pricing and simple pricing strategies.

Additionally, this pricing allows companies to adjust their pricing strategy based on market fluctuations and changing consumer demands, providing a flexible approach to pricing in dynamic market environments.

4. What tools can help streamline the cost-plus pricing process?

To streamline the pricing process and enhance efficiency, businesses can leverage various tools and software solutions designed to simplify cost calculations, markup adjustments, and pricing analyses.

Some popular tools that can help optimize this pricing strategy include: These tools often assist in refining the approach to ensure pricing is the right approach, blending cost-plus and market-based considerations.

- Cost Accounting Software: Automates cost calculations and provides real-time insights into production expenses, essential for businesses that often use this pricing strategy.

- Pricing Optimization Platforms: Offers data-driven pricing recommendations and competitive analysis to optimize markup percentages.

- ERP Systems: Integrates cost data across departments and streamlines pricing decisions for enhanced profitability.

5. How often should I review and adjust my cost-plus pricing strategy?

Regularly reviewing and adjusting your pricing strategy is essential to ensure competitiveness and profitability in the long run.

By monitoring market trends, analyzing cost fluctuations, and evaluating customer feedback, businesses can make informed decisions about pricing adjustments and markup revisions.

Aim to review your pricing strategy, including assessing the formula, at least quarterly or semi-annually to stay responsive to market changes and maintain a competitive edge.