Are you an entrepreneur juggling multiple business ideas?

Have you ever considered running multiple businesses under one sole proprietorship? Well, guess what, it’s doable!

Discover how operating multiple businesses under one sole proprietorship can streamline your ventures.

This flexible business structure offers simplicity and control, allowing you to manage diverse income streams efficiently.

Explore the advantages, challenges, and practical strategies for success in this comprehensive guide to maximizing your entrepreneurial potential.

Key Takeaways:

- Sole proprietorships can legally operate multiple businesses under one entity.

- Benefits include simplified legal structure, cost savings, and shared expenses.

- Challenges involve increased risk and potential conflicts between ventures.

- Effective strategies: streamline systems, set clear priorities, and share resources.

- Consider using DBAs (Doing Business As) to manage multiple business names.

Contents

ToggleAdvantages and Disadvantages of Managing Multiple Businesses Under One Entity

Let’s delve into the nitty-gritty, shall we?

Wrangling all your businesses, whether under one original LLC roof or deciding to form a new LLC for separate endeavors, comes with its fair share of pros and cons.

Advantages:

- Simplified Legal Structure: Rather than juggling multiple legal entities, you can keep things neat with just one LLC.

- Cost Savings: Save your hard-earned cash by overseeing all your businesses under a single LLC, cutting down on legal and accounting expenses.

- Shared Expenses for Small Business Owners: Sharing is caring! Merge resources like rent, utilities, and office supplies among your businesses to trim costs.

Disadvantages:

- Increased Risk: If one business hits a rough patch, it could have a ripple effect on the others under the same LLC.

- Conflicting Interests: Each business may have its agenda, potentially leading to conflicts that require some serious peacemaking skills.

- Financing Hurdles: A struggling business under the LLC could make it challenging to secure financing for the rest.

Legal Implications and Requirements

Legally speaking, there are no restrictions on the number of businesses you can operate as a sole proprietor.

However, come tax season, you’ll need to report the income from all your ventures in your ITR filing.

As a sole proprietor, you’re the lone wolf calling the shots and paying taxes on the business profits. Plus, for a small business owner, you don’t need a fancy business name; operating under your name works just fine.

Examples of Strategies for Managing Multiple Businesses Under One Sole Proprietorship

Running multiple businesses, especially when you want to operate each business under a different name, is akin to spinning plates; it demands finesse and a solid game plan.

Here are some strategies to help you keep those plates spinning without a crash landing:

- Streamline Your Systems: Develop standardized processes and embrace automation to lighten the load of day-to-day operations.

- Set Clear Priorities: Identify which businesses require your immediate attention based on factors like profitability and growth potential.

- Share Resources: Waste not, want not! Explore opportunities to share resources such as office space and staff to slash expenses.

- Diversify Your Portfolio: Spread your businesses across different industries to mitigate risk. If one falters, the others can pick up the slack.

What is Sole Proprietorship?

Imagine this: You’re the captain of your ship, steering through the entrepreneurial waters solo, making decisions, reaping rewards, and bearing risks.

That’s the essence of a Sole Proprietorship – a business owned and managed by a single individual.

Can You Operate Multiple Businesses Under One LLC?

Yes, you can run multiple businesses under one LLC, but consider the benefits of establishing a separate LLC or LLC holding company for each new business venture.

This setup is especially handy for freelancers, contractors, and entrepreneurs juggling various ventures.

For instance, if you kick-started an LLC for your freelance web design gig and later decided to dive into the world of graphic design, you could manage both under the same LLC umbrella.

Just remember, if there are other partners in the LLC, you’d typically need their nod of approval.

Differences Between Sole Proprietorship and LLC for Managing Multiple Businesses

In one corner, we have the lone ranger, the sole proprietorship; a solo act where personal and business assets are inseparable pals.

This means you’re personally liable for all debts and obligations. Talk about pressure!

On the other side, we have the LLC, offering the comforting shield of personal asset protection.

Your business debts stay in their lane, and your assets remain safe. Phew!

Forming an LLC with Multiple DBAs

Did you know that an LLC can sport multiple Doing Business As (DBA) names?

This allows an owner of the LLC to conduct business under various aliases.

That’s right, there’s no legal limit on the number of DBAs your LLC can flaunt, making it easier to expand your small business portfolio by creating another business or more.

This flexibility allows you to operate multiple businesses without the headache of setting up separate legal entities for each. It’s like having a versatile wardrobe with different hats for every occasion.

The Pros and Cons of LLC vs Sole Proprietorship for Managing Multiple Ventures

Imagine this: with an LLC, you get the superhero cape of limited liability.

Each business under separate LLCs means their assets and income are shielded from each other’s liabilities.

It’s like having a force field protecting each venture.

However, setting up an LLC does come with upfront paperwork and costs. But hey, the long-term benefits might just make it rain dollars!

How to Utilize DBAs for Managing Multiple Businesses

Imagine this: you’re running a successful business called “ABC Investment LLC” but want to venture into new opportunities without the hassle of setting up separate entities.

Enter DBAs (Doing Business As), your secret weapon.

A DBA allows your business to operate under a different name than its official legal one. It’s like giving your business a cool alias that customers can easily remember.

But why bother with a DBA, you ask?

Well, besides giving your business a catchy name, a DBA can do wonders for your credibility, particularly when you establish a sole proprietorship.

It streamlines the process of opening a business bank account for each separate business and enables you to market your business in different directions without the headache of creating new legal entities each time.

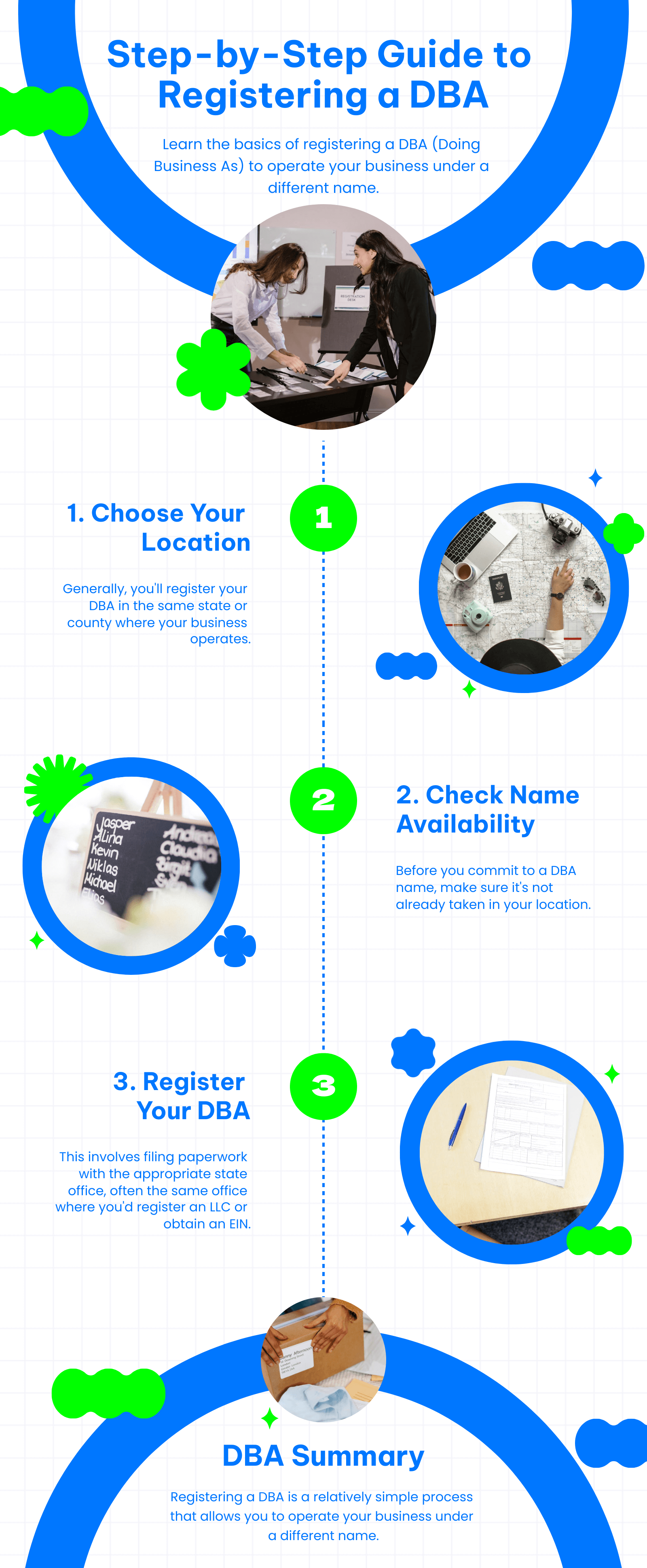

Step-by-Step Guide to Registering a DBA

Now, let’s delve into the specifics of registering a DBA.

While the process may vary from state to state, here are the general steps you’ll need to follow to form a new LLC or register a business under a different name:

- Choose Your Location: Typically, you’ll register your DBA for doing business under a different name in the same state or county where you operate.

- Check Name Availability: Before falling in love with a name, ensure it’s available in your chosen location. Unique names are the name of the game, which is essential when a proprietor can have multiple DBAs to distinguish their multiple businesses operating under one entity.

- Register Your DBA With the State: This crucial step usually involves the same office where you’d register an LLC or obtain an EIN for your new business. Think county clerk, department of revenue, or secretary of state, especially when registering a business under a different name or establishing another LLC.

How Many DBAs Can a Sole Proprietor Have?

As a sole proprietor or business owner, the number of DBAs you can acquire for starting another business depends on your situation and state regulations.

In most cases, there’s no strict limit on the number of DBAs you can register.

The caveat? Each name must be unique and not already in use by another company in your state. Keep in mind, though, that registering multiple DBAs can incur costs, so think twice before going DBA-crazy.

Am I required to register a DBA for my LLC?

Once your LLC is set up, you might be wondering if registering a DBA (Doing Business As) is necessary.

The simple answer is no, it’s not a requirement to have a unique business name for each new business, but having an EIN for separate entities is recommended.

Think of a DBA as a cool alias for your business, allowing you to operate under a different name than your LLC’s official one, offering flexibility, and making it easier to establish a sole proprietorship or separate business identities.

It can be useful for branding purposes or exploring new product lines without the need for a separate legal entity.

Is Having 2 LLCs a Better Option?

Now, let’s explore the idea of having not just one, but two LLCs.

It may sound sophisticated, but before jumping into multiple LLCs, consider the pros and cons.

Managing more than one LLC can provide enhanced asset protection, tax advantages, business diversification, operational flexibility, brand protection, and improved access to funding.

It’s like adding extra layers of security for your businesses.

How does this affect my taxes?

For One LLC

So, you’ve ventured into the realm of a single-member LLC, huh? Brace yourself for a rollercoaster ride through the tax landscape!

When it comes to the IRS, your single-member LLC is akin to that sidekick who blends into the background (ouch), especially when operating as a disregarded entity where the owner of the LLC might need to file multiple Schedule Cs.

It’s classified as a disregarded entity, meaning the profits flow through to your tax return, potentially on two Schedule Cs if you’re operating businesses under separate entities.

You’re the one left footing the tax bill on those profits, welcome to the world of pass-through taxation!

But hold on, there’s a twist!

You also have the option to shake things up and opt for taxation as a corporation.

Imagine this: you’re making $100,000 annually and shelling out a hefty $15,300 in self-employment taxes (Social Security and Medicare).

If you pivot and transform into an S Corporation, drawing a $50,000 salary and a $50,000 profit distribution, you could slash your self-employment tax to a mere $8,310.

That’s a cool $6,990 saved right there!

For Multiple LLCs

Now, let’s unravel the tax labyrinth when you own multiple LLCs, including the benefits of creating an LLC for each new business entity.

Each LLC stands as its miniature realm, necessitating individual tax filings. Managing multiple LLCs is akin to herding cats; it’s time-intensive, demands top-notch organizational skills, and can deplete your resources quicker than you can say “tax deductions.”

But fear not, intrepid entrepreneur, even as you navigate the complexities of business insurance for your original LLC or any new entities you establish.

Multiple LLCs bring perks like asset protection and flexibility for your assorted business ventures.

Envision being able to maneuver income and deductions among entities, such as between your new LLC and a parent LLC, play with intercompany transactions for tax advantages, and seize those targeted tax credits and deductions.

It’s like having a squadron of tax-saving superheroes at your disposal!

Separate Bank Accounts

The humble bank account; is a beacon of financial order amidst the chaos of business ownership, even more so when dealing with accounts for businesses under different names or another LLC.

Maintaining a separate bank account for each LLC is non-negotiable.

It’s akin to having distinct lockers for each of your kids, it keeps things organized and averts any mix-ups.

You may wonder why this practice of having multiple businesses operating under one entity is so vital, you may wonder?

Well, firstly, it upholds the legal and financial integrity of each LLC. Moreover, it’s a breeze to manage and keeps you in the good graces of the taxman.

Segregating your personal and business finances is crucial for upholding that limited liability protection, you wouldn’t want Uncle Sam knocking on your door for a tax audit!

Advantages of a Sole Proprietorship

1. Easy to Establish

Starting a business as a sole proprietor is as quick and simple as whipping up a bowl of instant noodles.

No need for convoluted paperwork or intricate registration processes.

Just grab the necessary license, like how a medical shop owner needs one to dispense those pills, and you’re good to go.

2. Total Control

Picture yourself as the captain of your ship, making decisions at lightning speed without anyone looking over your shoulder, akin to managing a business under a different name with full autonomy.

That’s the beauty of a sole proprietorship; you’re the boss, and as a sole proprietor can have multiple DBAs, you’re in full control of your business models.

With all the power and responsibility on your shoulders as a small business owner, you have the freedom to navigate your business in any direction you choose.

3. Tax Payments

When it comes to taxes, being a sole proprietor means you’re in the driver’s seat.

No corporate taxes to worry about, it’s just you and the taxman.

While you bear all the risks solo, you also get to enjoy all the profits without sharing a penny.

It’s a high-risk, high-reward game, but hey, that’s entrepreneurship for you.

4. Simple Banking Process

Imagine a stress-free banking experience with minimal paperwork.

That’s the luxury of running a sole proprietorship. Compared to other business structures, the banking side of things is a breeze, especially when you form a new LLC for each separate business, streamlining financial management and keeping the operations separate from one another.

Sometimes, you might not even need to fill out any paperwork at all.

It’s like banking made easy, just for you.

Disadvantages of a Sole Proprietorship

Now, Let’s dive into the realities of running a sole proprietorship.

While being your boss has its perks, it’s not all rainbows and sunshine.

Let’s shed some light on the challenges you might face when going solo in the business world.

1. No Asset Protection

Imagine this: your business hits a rough patch, and suddenly, you’re knee-deep in debt.

Well, in a sole proprietorship, your business and personal assets are like conjoined twins; inseparable.

This means if your business tanks, you might have to dip into your piggy bank to settle those pesky debts.

Say goodbye to that dream vacation or fancy new car!

2. Difficulties in Raising Capital

Dreaming of expanding your business but strapped for cash?

Tough luck, my friend.

Unlike big-shot corporations that can sell shares to raise capital, sole proprietors have a tougher time convincing lenders to hand over the dough.

With limited assets to back you up in launching another business, you might find yourself knocking on every bank’s door or even considering selling your prized possessions just to keep the lights on.

3. Business Dies With Owner

Here’s a sobering thought; in a sole proprietorship, your business’s fate is tied to yours, but if you form a new LLC, you could mitigate personal risk and still have the flexibility if the proprietor can have multiple DBAs.

When you shuffle off this mortal coil, so does your business.

Your loved ones might have to deal with the aftermath; selling off assets, transferring ownership, or worst-case scenario, shutting it all down. It’s like a business funeral but without the flowers.

Managing Finances for Multiple Businesses Under One Sole Proprietorship

A sole proprietorship is a private company owned by a single person who pays personal income tax on business profits.

Many entrepreneurs are drawn to the idea of having multiple income streams and often venture into establishing additional businesses under the same ownership, even if the business activities are vastly different.

For instance, a business coach running a sole proprietorship for years might also invest in a strip mall under a limited liability company (LLC).

Keeping Financial Records Separate

It’s paramount for a business owner to maintain distinct financial records for each of their businesses, whether they’re a new LLC or an established entity.

By meticulously tracking revenue, expenses, and profits separately for each new business you own, you’ll gain a clear insight into the financial well-being of each venture.

Make use of efficient financial software and tools to streamline this process.

Remember, the separation of personal and business accounts is non-negotiable.

Consider utilizing a “doing business as” (DBA) option for clarity in differentiation.

Tax Considerations and Reporting for Multiple Businesses

When it comes to filing Income Tax Returns (ITR) for multiple businesses under one PAN, precise calculations are crucial.

It’s essential to report the income and expenses of each business separately.

For unrelated businesses structured as sole proprietorships, preparing individual Schedule C forms for each is advisable.

Exploring the possibility of segregating businesses into different entities can offer tax advantages worth exploring.

Best Practices in Financial Management Across Different Businesses

Efficient financial management practices serve as the foundation for successful multi-business ownership, especially when operating two businesses or more.

Regularly maintaining accounting records, leveraging top-tier financial software, and ensuring timely tax filings are imperative.

Remember, effective time management is essential when handling multiple ventures.

Stay organized, meet deadlines consistently, and witness your businesses flourish.

People Also Asked

1. Can a Sole Proprietor Have Multiple Locations?

Yes, indeed!

A sole proprietor can flex their entrepreneurial muscles and establish a presence in multiple locations.

However, before you start setting up shop left, right, and center, make sure you’re on top of all the state registration and business license requirements, especially if you want to operate each business using a separate entity.

In India, you can even take it a step further and operate more than one company, talk about multitasking like a pro!

2. Can a Sole Proprietorship Have More Than One Owner?

Nope, a sole proprietorship is a one-person show-through and through.

If you’re the proud owner of a sole proprietorship, you’re the captain of your ship, steering it solo toward success.

3. Benefits of Running Multiple Businesses Under One Sole Proprietorship?

Why limit yourself to just one venture when you can juggle multiple businesses under the same umbrella?

Here are some perks to consider:

- Ease of Establishment: Say goodbye to the paperwork headache and save precious time and money.

- Total Control: You’re the boss, making decisions without the need to consult partners or shareholders.

- Tax Simplicity: Tax season becomes a breeze compared to other business structures.

- Diversification: Multiple businesses mean diversified revenue streams, increased earning potential, and a boost in productivity, especially when these businesses are separate from one another.

4. How Do DBAs Work for Sole Proprietorships?

If you’re thinking of operating under a different name than your legal one, it’s time to embrace the DBA (Doing Business As) concept.

File a DBA with your state’s secretary of state to make your alternate business name official.

5. Are There Limits to How Many DBAs a Sole Proprietor Can Have?

The sky’s the limit when it comes to juggling DBAs for your new business, depending on your state’s regulations.

Just make sure each trade name is unique to avoid any legal entanglements.

6. What Are the Risks of Operating Multiple Businesses as a Sole Proprietor?

While the idea of running multiple businesses may sound exhilarating, it comes with its fair share of risks.

Since each DBA isn’t considered a separate entity by the IRS, they’re seen as one entity.

This can complicate matters when claiming losses or put all your assets at risk if one business encounters legal troubles.

Be mindful of the potential downsides, including less protection, higher taxes, funding challenges, and limited benefits compared to W-2 employees.