Starting a new venture is exciting, but startup project risk management is crucial to success.

Did you know that about 90% of startups fail, with 10% failing within the first year? Many of these failures can be attributed to poor risk management.

That’s why implementing effective risk management strategies is essential for your startup’s survival and growth.

Learn the top 15 risk management strategies for startup projects to avoid pitfalls and thrive.

Key Takeaways:

- Risk Identification & Assessment: Identify and evaluate potential risks early to develop effective mitigation strategies.

- Prioritize with Risk Matrix: Use a risk matrix to focus on high-priority risks, optimizing resource allocation.

- Develop Mitigation Plans: Create specific action steps to reduce the impact and likelihood of identified risks.

- Contingency Planning: Prepare for worst-case scenarios with backup plans to ensure business continuity.

- Regular Risk Monitoring: Continuously monitor and review risks to adapt strategies as your startup evolves.

- Leverage Insurance: Transfer financial risk by obtaining appropriate insurance policies for protection.

- Maintain Cash Reserves: Keep an emergency fund to handle unforeseen expenses and financial challenges.

- Build a Strong Team: Recruit diverse talent and cross-train employees for flexibility and resilience.

- Strategic Partnerships: Collaborate with others to share resources, and expertise, and reduce risks.

- Agile Project Management: Adopt agile methodologies to quickly adapt to changes and reduce project risks.

- Compliance Management: Stay updated with laws and regulations to avoid legal penalties and risks.

- Stakeholder Communication: Maintain open communication to manage expectations and build trust.

- Market Research: Conduct thorough market analysis to anticipate risks and seize opportunities.

- Scenario Analysis: Use stress testing and what-if scenarios to prepare for various outcomes.

- Technological Safeguards: Implement cybersecurity measures and stay current with technology to avoid tech risks.

Contents

ToggleUnderstanding Risk Management in Startups

Why Risk Management is Essential for Startup Success

In the fast-paced world of startups, risk is an ever-present companion.

But here’s the kicker: it’s not about avoiding risks altogether (that’s impossible!).

It’s about managing them smartly.

Consider this: According to a CB Insights report, 70% of upstart tech companies fail, usually around 20 months after first raising financing.

This sobering statistic underscores the volatile nature of startups and the critical need for effective risk management.

So, why exactly is risk management a make-or-break factor for startups?

- Survival in a Competitive Landscape: In a world where 90% of startups fail, proper risk management can be your lifeline. It helps you navigate uncertainties and stay afloat when others are sinking.

- Resource Optimization: Startups often operate on tight budgets. Effective risk management ensures you’re allocating your limited resources where they matter most.

- Agility and Adaptability: In the startup world, change is the only constant. Risk management helps you stay nimble and pivot when necessary, without losing sight of your core objectives.

Types of Risks Faced by Startups

Startups face a unique set of risks that can threaten their growth and survival.

Understanding these risks is the first step in developing effective mitigation strategies.

Here are the primary types of risks that startups commonly encounter:

- Financial Risks:

- Cash flow problems.

- Inability to secure funding.

- Unexpected expenses.

- Operational Risks:

- Supply chain disruptions.

- Quality control issues.

- Scaling challenges.

- Market Risks:

- Changing customer preferences.

- New competitors.

- Economic downturns.

- Regulatory Risks:

- Changes in laws and regulations.

- Compliance issues.

- Intellectual property disputes.

- Technological Risks:

- Rapid tech obsolescence.

- Cybersecurity threats.

- Integration challenges with legacy systems.

- Team Risks:

- Skill gaps.

- High turnover.

- Co-founder conflicts.

By identifying these risks early and developing strategies to mitigate them, you can significantly increase your startup’s chances of success.

Remember, in the world of startups, it’s not about avoiding risks, it’s about managing them effectively to fuel your growth and innovation.

15 Effective Risk Management Strategies For Startups

1. Risk Identification and Assessment

The first step in any effective risk management process is identifying and assessing potential risks.

This crucial stage sets the foundation for all your risk mitigation efforts.

Steps to Identify Potential Risks

- Brainstorming Sessions: Gather your team and conduct regular brainstorming sessions. A study by the Project Management Institute found that organizations that use risk identification techniques are 74% more likely to have project success.

- Risk Checklists: Develop and maintain a comprehensive risk checklist tailored to your startup’s industry and specific circumstances. Update it regularly as new risks emerge.

- SWOT Analysis: Conduct a SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis to identify internal and external factors that could pose risks to your startup.

- External Expert Consultation: Don’t hesitate to bring in external experts or advisors. Their fresh perspective can help identify risks you might have overlooked.

- Historical Data Analysis: If available, analyze data from past projects or similar startups in your industry to identify common pitfalls.

Assessing Risk Impact and Probability

Once you’ve identified potential risks, it’s time to assess their potential impact and likelihood of occurrence.

This helps you prioritize your risk mitigation efforts.

Use both qualitative and quantitative methods:

- Qualitative Assessment: Use a simple scale (e.g., Low, Medium, High) to rate the impact and probability of each risk.

- Quantitative Assessment: Assign numerical values to impact and probability. For example:

- Impact: 1 (Minor) to 5 (Catastrophic)

- Probability: 1 (Rare) to 5 (Almost Certain)

Then, multiply the impact and probability scores to get a risk score.

This allows you to rank risks objectively.

| Risk | Impact (1-5) | Probability (1-5) | Risk Score |

| Cash flow shortage | 5 | 3 | 15 |

| Key employee turnover | 4 | 2 | 8 |

| Data breach | 5 | 2 | 10 |

Remember, risk assessment isn’t a one-time activity.

According to McKinsey, leading companies reassess risks on a quarterly and even monthly basis.

Make it a regular part of your startup’s operations.

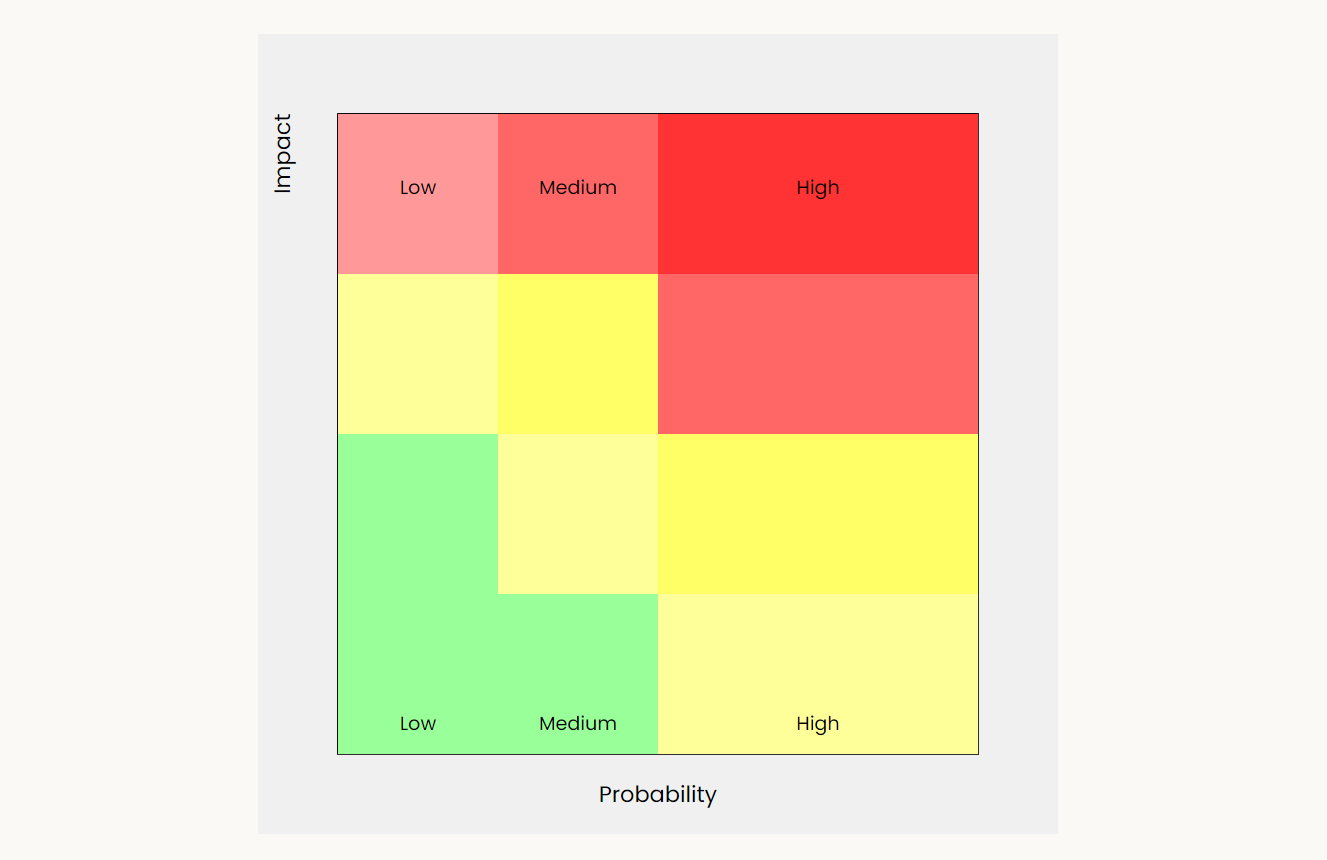

2. Prioritization of Risks Using a Risk Matrix

Once you’ve identified and assessed your risks, the next step is to prioritize them.

This is where a risk matrix comes in handy.

How to Create and Use a Risk Matrix

A risk matrix is a visual tool that helps you prioritize risks based on their impact and probability. Here’s how to create one:

- Create a 5×5 grid with impact on one axis and probability on the other.

- Plot your identified risks on the grid based on their impact and probability scores.

- Color-code the grid: Red for high-priority risks, yellow for medium, and green for low.

Here’s an example of a simple risk matrix:

Focusing on High-Priority Risks

Once you’ve plotted your risks on the matrix, focus your attention and resources on the high-priority (red) risks first.

These are the risks that could have a severe impact on your startup and have a high probability of occurring.

Remember, while it’s important to address high-priority risks first, don’t completely ignore lower-priority risks.

They should still be monitored and reassessed regularly, as their impact or probability may change over time.

By implementing these first two strategies, risk identification and assessment, and risk prioritization, you’re laying a solid foundation for your startup’s risk management efforts.

In the next sections, we’ll explore how to develop mitigation plans for these identified and prioritized risks.

3. Developing a Risk Mitigation Plan

Once you’ve identified and prioritized your risks, the next crucial step is developing a robust risk mitigation plan.

This plan outlines specific actions to reduce the likelihood of risks occurring or minimize their impact if they do occur.

Creating Specific Action Steps for Each Risk

For each high-priority risk, develop a set of concrete action steps.

Here’s a simple framework to follow:

- Define the Risk: Clearly state what the risk is and its potential impact.

- Set Objectives: What do you aim to achieve with your mitigation efforts?

- Outline Actions: List specific steps to mitigate the risk.

- Assign Responsibility: Determine who will be responsible for each action.

- Set Timelines: Establish deadlines for implementing each action.

- Determine Resources: Identify what resources (time, money, personnel) are needed.

- Establish Metrics: Define how you’ll measure the effectiveness of your mitigation efforts.

Examples of Risk Mitigation in Real Startup Scenarios

Let’s look at a real-world example to illustrate this process:

Risk: Cash flow shortage due to delayed client payments.

Mitigation Plan:

- Implement stricter payment terms (e.g., require 50% upfront for large projects).

- Set up an automated invoice follow-up system.

- Offer early payment discounts.

- Establish a line of credit with a bank as a backup.

Responsible: Finance Manager, Timeline: Implement within 30 days, Resources: Staff time, invoicing software ($50/month), Metrics: Reduce average payment time from 45 to 30 days.

By implementing a robust mitigation plan like this, you can significantly reduce this risk.

4. Contingency Planning

In the volatile world of startups, expecting the unexpected isn’t just a cliché, it’s a survival strategy.

Contingency planning is your startup’s safety net, ensuring you’re prepared for those “what if” scenarios that can make or break your business.

Planning for Worst-Case Scenarios

When it comes to contingency planning, it’s time to embrace your inner pessimist (just this once).

Here’s how to prepare for those stormy days:

- Identify potential crises: Brainstorm scenarios that could significantly impact your startup. This could range from a major client suddenly pulling out to a critical team member leaving.

- Develop response strategies: For each scenario, outline specific steps to mitigate the impact. This might include having a list of potential replacement suppliers or a succession plan for key roles.

- Allocate resources: Determine what resources (financial, human, technological) you’d need to implement each contingency plan.

- Document and communicate: Create a clear, accessible document detailing your contingency plans and ensure all relevant team members are familiar with it.

- Regular reviews: The startup landscape changes rapidly. Review and update your contingency plans quarterly to ensure they remain relevant.

How to Build an Effective Response Team

Your response team is your SWAT team for crises.

Here’s how to assemble and prepare them:

- Diverse skill set: Include team members from different departments to ensure a well-rounded perspective.

- Clear roles and responsibilities: Assign specific roles (e.g., communications lead, operations manager) to avoid confusion during high-stress situations.

- Training and drills: Conduct regular training sessions and simulated crisis scenarios to keep the team sharp.

- Decision-making authority: Empower the team with the authority to make quick decisions during a crisis.

- Communication protocols: Establish clear communication channels and protocols for both internal and external communications during a crisis.

Remember, the goal of contingency planning isn’t to predict the future, it’s to prepare your startup to adapt quickly and effectively when the unexpected occurs.

By having these plans in place, you’re not just managing risk, you’re building a more resilient, agile organization ready to weather any storm.

5. Regular Risk Monitoring and Review

In the fast-paced startup world, yesterday’s minor hiccup can become today’s major crisis.

That’s why regular risk monitoring and review isn’t just a good practice, it’s a lifeline for your business.

Setting Up Risk Monitoring Systems

Effective risk monitoring is like having a health tracker for your startup. Here’s how to set one up:

- Choose the right tools: Invest in risk management software that fits your startup’s size and needs. Tools like Jira or RiskLens can help track and visualize risks over time.

- Establish key risk indicators (KRIs): These are quantifiable metrics that signal potential risks. For a SaaS startup, KRIs might include customer churn rate or server downtime frequency.

- Create a risk dashboard: Develop a centralized dashboard that displays your KRIs and other risk-related data in real-time.

- Set up automated alerts: Configure your system to send notifications when KRIs exceed predefined thresholds.

- Assign responsibility: Designate team members to monitor specific risk areas and report findings regularly.

Adjusting Risk Management Plans Over Time

Your risk management plan should be as dynamic as your startup.

Here’s how to keep it fresh and relevant:

- Schedule regular reviews: Set up quarterly risk review meetings to assess the effectiveness of your current strategies.

- Conduct post-mortem analyses: After any risk event (whether successfully mitigated or not), analyze what happened and how your response could be improved.

- Stay informed about industry trends: Keep an eye on emerging risks in your sector. Resources like CB Insights can provide valuable insights into industry trends and potential disruptions.

- Incorporate feedback: Encourage team members to provide input on risk management processes. They’re often the first to notice new risks or inefficiencies in current strategies.

- Update your risk register: Regularly update your list of identified risks, removing obsolete ones and adding new potential threats.

- Reassess risk appetite: As your startup grows and evolves, your tolerance for certain risks may change. Regularly reassess and adjust your risk appetite accordingly.

By implementing these practices, you’re not just managing risks, you’re creating a culture of proactive risk awareness.

This ongoing vigilance can be the difference between a startup that survives unexpected challenges and one that thrives because of them.

6. Leveraging Insurance for Risk Transfer

In the startup world, where every dollar counts, insurance might seem like an unnecessary expense.

But think of it as your financial airbag, you hope you never need it, but you’ll be glad it’s there if you do.

Types of Insurance Policies Relevant to Startups

Navigating the insurance landscape can be tricky for startups.

Here are some key policies to consider:

- General Liability Insurance: This is your basic “slip and fall” coverage, protecting you from third-party claims of bodily injury or property damage.

- Professional Liability Insurance (Errors and Omissions): If your startup provides professional services or advice, this protects you from claims of negligence or failure to perform your professional duties.

- Cyber Insurance: In our digital age, this is becoming increasingly crucial. It covers losses from data breaches, hacking, and other cyber events.

- Property Insurance: This covers damage to your physical assets, including office space, equipment, and inventory.

- Directors and Officers (D&O) Insurance: This protects your leadership team from personal losses if they’re sued as a result of performing their job duties.

- Business Interruption Insurance: If a disaster forces you to temporarily shut down operations, this helps cover ongoing expenses and lost income.

- Product Liability Insurance: If you’re selling physical products, this protects you from claims related to product defects or safety issues.

How Insurance Mitigates Financial Risk

Insurance acts as a financial shock absorber for your startup.

Here’s how it helps:

- Risk Transfer: Insurance transfers the financial burden of certain risks from your startup to the insurance company.

- Legal Protection: Many policies include coverage for legal fees, which can be substantial in the event of a lawsuit.

- Business Continuity: Policies like business interruption insurance help ensure your startup can survive unexpected events that disrupt operations.

- Credibility Boost: Having appropriate insurance coverage can make your startup more attractive to potential investors, partners, and customers.

- Peace of Mind: Knowing you’re protected allows you to focus on growing your business rather than worrying about potential disasters.

According to a study by the Small Business Administration, 40% of small businesses never reopen after a disaster.

Proper insurance coverage can significantly improve your odds of being in the 60% that survive.

Remember, the key is to tailor your insurance coverage to your specific risks.

Work with an insurance broker who understands the unique needs of startups in your industry.

They can help you find the right balance between comprehensive coverage and manageable premiums.

By leveraging insurance effectively, you’re not just protecting your startup from financial risks, you’re investing in its long-term sustainability and success.

7. Maintaining a Cash Reserve for Emergencies

In the startup world, cash is king, and a healthy cash reserve is your kingdom’s best defense against unexpected threats.

Let’s dive into why having a financial buffer is crucial and how to build one effectively.

Importance of Financial Buffers

Think of your cash reserve as your startup’s financial shock absorber.

Here’s why it’s indispensable:

- Weathering Market Fluctuations: Markets can be unpredictable. A cash reserve helps you navigate through lean periods without resorting to desperate measures.

- Seizing Opportunities: Sometimes, the best opportunities come when you least expect them. A cash reserve gives you the flexibility to act quickly when a game-changing opportunity arises.

- Handling Unexpected Expenses: From equipment breakdowns to surprise tax bills, unexpected expenses are a fact of startup life. A cash reserve ensures these don’t derail your operations.

- Boosting Investor Confidence: Investors love to see responsible financial management. A healthy cash reserve signals that you’re prepared for uncertainties.

- Reducing Stress: Running a startup is stressful enough. Knowing you have a financial cushion can provide peace of mind and allow you to focus on growth.

Tips for Building and Managing an Emergency Fund

Building a cash reserve isn’t about hoarding every penny.

It’s about striking a balance between financial security and growth.

Here’s how to do it:

- Set a Target: Aim to have 3-6 months of operating expenses in reserve. For startups in volatile industries or with irregular income, consider aiming for the higher end of this range.

- Start Small: If you’re just starting out, begin with a goal of setting aside 1% of your revenue. Gradually increase this percentage as your business stabilizes.

- Automate Savings: Set up automatic transfers to your reserve fund. Treat it like any other non-negotiable business expense.

- Use a High-Yield Savings Account: Make your reserve work for you by storing it in an account that earns interest. Just ensure it remains easily accessible.

- Review and Adjust Regularly: As your business grows and changes, so will your financial needs. Review your reserve quarterly and adjust your savings strategy as necessary.

- Keep It Separate: Maintain your emergency fund in a separate account from your operating cash. This reduces the temptation to dip into it for non-emergencies.

- Define ‘Emergency’: Clearly outline what constitutes an emergency worthy of tapping into this fund. This helps prevent misuse.

- Replenish Quickly: If you do need to use your reserve, make replenishing it a top priority once the crisis has passed.

Remember, building a cash reserve isn’t about stifling growth, it’s about creating a stable foundation for sustainable expansion.

By implementing these strategies, you’re not just preparing for rainy days, you’re setting your startup up for long-term success, come rain or shine.

8. Building a Strong and Flexible Team

In the startup world, your team isn’t just your workforce, it’s your most valuable asset and your first line of defense against risks.

Let’s explore how to build a team that’s not only strong but also flexible enough to adapt to the ever-changing startup landscape.

Recruiting Team Members with Diverse Skills

Diversity isn’t just a buzzword, it’s a strategic advantage.

Here’s why and how to build a diverse team:

- Complementary Skill Sets: Look for team members whose skills complement, not just replicate, existing team strengths. This creates a more robust, well-rounded team.

- Cognitive Diversity: Seek out individuals with different thought processes and problem-solving approaches. This diversity of thought can lead to more innovative solutions.

- Industry Experience: Balance fresh perspectives with industry experience. A mix of startup enthusiasts and seasoned professionals can provide a powerful combination of innovation and practicality.

- Cultural Add, Not Just Fit: Look for individuals who can add to your company culture, not just fit into it. This approach promotes diversity and helps your culture evolve.

- Adaptability: In the fast-paced startup environment, adaptability is key. Look for candidates who have demonstrated the ability to wear multiple hats and learn quickly.

According to a McKinsey study, companies in the top quartile for ethnic and cultural diversity on executive teams were 33% more likely to have industry-leading profitability.

Cross-Training Employees

Cross-training is your insurance policy against skill gaps and unexpected departures.

Here’s how to implement an effective cross-training program:

- Identify Key Functions: Start by mapping out the critical functions in your startup. These are the areas where cross-training can have the biggest impact.

- Create Learning Opportunities: Encourage job shadowing, mentoring relationships, and temporary role swaps to facilitate knowledge transfer.

- Develop a Skills Matrix: Create a visual representation of who knows what in your organization. This helps identify areas for cross-training and potential vulnerabilities.

- Incentivize Learning: Reward employees who actively engage in cross-training. This could be through recognition, additional responsibilities, or even financial incentives.

- Use Technology: Leverage e-learning platforms and knowledge management systems to make cross-training more accessible and efficient.

- Regular Skill Assessments: Conduct periodic skill assessments to track progress and identify new areas for cross-training.

- Encourage Teaching: Have employees who excel in certain areas lead training sessions. This reinforces their own knowledge while benefiting the team.

- Make it Part of the Culture: Integrate cross-training into your company culture. Make it clear that continuous learning and flexibility are valued and expected.

A study by the Association for Talent Development found that companies that offer comprehensive training programs have 218% higher income per employee than companies without formalized training.

Building a strong and flexible team isn’t just about hiring the right people, it’s about creating an environment where they can continuously grow and adapt.

By focusing on diverse skill sets and implementing robust cross-training programs, you’re not just mitigating risks, you’re creating a resilient, agile organization capable of turning challenges into opportunities.

9. Strategic Partnerships and Alliances

In the fast-paced startup world, going it alone can be a risky proposition.

Strategic partnerships and alliances offer a powerful way to share resources, mitigate risks, and accelerate growth.

Here’s how startups can leverage these relationships to manage risk effectively:

Collaborating with Established Companies

Partnering with established companies can provide startups with invaluable resources and risk-sharing opportunities:

- Access to Resources: Established partners can offer access to capital, technology, and market insights that would be difficult for a startup to obtain on its own.

- Credibility Boost: Associating with a well-known brand can enhance a startup’s reputation and open doors to new opportunities.

- Risk Distribution: By sharing project costs and responsibilities, startups can reduce their financial exposure and operational risks.

This statistic underscores the potential impact of strategic alliances on startup success and risk mitigation.

Joint Ventures and Co-Development Agreements

Joint ventures and co-development agreements are specific forms of partnerships that can be particularly effective for risk management:

- Joint Ventures: These allow startups to team up with other companies to tackle projects or enter markets that might be too risky to approach alone.

- Co-Development Agreements: By collaborating on product development, startups can share R&D costs and reduce the risk of market failure.

Best Practices for Forming Strategic Partnerships

To maximize the benefits and minimize risks associated with partnerships:

- Conduct Thorough Due Diligence: Research potential partners to ensure alignment in values, goals, and operational practices.

- Clear Communication: Establish open lines of communication and set clear expectations from the outset.

- Formal Agreements: Use detailed contracts that outline roles, responsibilities, and risk-sharing mechanisms.

- Regular Evaluation: Continuously assess the partnership’s performance and be prepared to adjust or exit if necessary.

By thoughtfully approaching strategic partnerships and alliances, startups can create a powerful risk management tool that not only protects against potential threats but also opens doors to new opportunities for growth and innovation.

10. Adopting Agile Project Management Practices

In the dynamic world of startups, where change is the only constant, agile project management practices can be a game-changer for effective risk management.

Agile methodologies provide the flexibility and adaptability needed to navigate uncertainties and respond quickly to market shifts.

Benefits of Agile Methodologies

Agile project management offers several advantages that directly contribute to risk mitigation:

- Flexibility: Agile allows teams to adapt quickly to changes in project requirements or market conditions.

- Continuous Feedback: Regular check-ins and iterations provide opportunities to identify and address risks early.

- Improved Visibility: Daily stand-ups and sprint reviews keep all stakeholders informed, reducing the risk of miscommunication.

- Faster Time-to-Market: By delivering working products in short sprints, startups can test market reception and adjust strategies rapidly.

This statistic highlights the potential of agile methodologies to enhance project success and, by extension, reduce risks.

Implementing Agile in a Startup Environment

To effectively adopt agile practices and reap their risk management benefits:

- Start Small: Begin with a pilot project or a single team to test and refine your agile approach.

- Educate and Train: Invest in agile training for your team to ensure everyone understands the principles and practices.

- Choose the Right Tools: Select project management tools that support agile methodologies, such as Jira or Trello.

- Embrace the Agile Mindset: Encourage a culture of collaboration, transparency, and continuous improvement.

- Regular Retrospectives: Hold sprint retrospectives to identify what’s working well and areas for improvement in your risk management approach.

Agile Risk Management Techniques

Incorporate these agile-specific risk management techniques into your startup’s workflow:

- Risk Burndown Charts: Visualize and track identified risks throughout the project lifecycle.

- Risk-Based Spike: Allocate time to investigate high-priority risks and develop mitigation strategies.

- Frequent Demos: Showcase work-in-progress to stakeholders regularly to catch potential issues early.

Case Study: Spotify’s Agile Success

Spotify is renowned for its unique take on agile methodologies, which has been crucial to its risk management and rapid growth.

The company uses a model of “squads,” “tribes,” and “guilds” to maintain agility at scale. This approach allows Spotify to:

- Quickly adapt to market changes and user preferences.

- Foster innovation while managing the risks associated with new features.

- Maintain a startup culture even as the company grows.

By adopting agile practices tailored to your startup’s needs, you can create a responsive, risk-aware environment that’s better equipped to handle the uncertainties of the entrepreneurial journey.

11. Compliance and Regulatory Risk Management

In today’s complex business landscape, compliance and regulatory risks pose significant challenges for startups.

Failing to navigate these waters effectively can lead to hefty fines, legal troubles, and reputational damage.

Here’s how startups can manage these risks effectively:

Understanding the Regulatory Landscape for Startups

The regulatory environment varies widely depending on your industry, location, and business model. Key areas to consider include:

- Data Protection: Regulations like GDPR in Europe or CCPA in California.

- Financial Regulations: Such as SOX for public companies or PCI DSS for handling credit card data.

- Industry-Specific Regulations: For example, HIPAA in healthcare or FDA regulations for food and drug companies.

- Employment Laws: Including minimum wage, overtime, and anti-discrimination regulations.

- Environmental Regulations: Particularly important for manufacturing or energy startups.

This underscores the growing importance of effective compliance risk management for startups.

Implementing a Compliance Program

To ensure legal adherence and mitigate regulatory risks, startups should:

- Conduct a Compliance Audit: Identify all relevant regulations and assess your current compliance status.

- Develop Policies and Procedures: Create clear guidelines that align with regulatory requirements.

- Appoint a Compliance Officer: Designate someone to oversee compliance efforts, even if it’s a part-time role initially.

- Provide Training: Educate all employees on compliance requirements relevant to their roles.

- Implement Monitoring Systems: Use software tools to track compliance activities and flag potential issues.

- Regular Review and Update: Stay informed about regulatory changes and update your compliance program accordingly.

Best Practices for Startup Compliance

- Start Early: Don’t wait until you’re scaling to think about compliance. Building it into your operations from the start is more cost-effective.

- Leverage Technology: Use compliance management software to automate and streamline processes.

- Seek Expert Advice: Consider consulting with legal experts or industry-specific compliance consultants.

- Foster a Culture of Compliance: Encourage all team members to prioritize ethical behavior and regulatory adherence.

By implementing a robust compliance and regulatory risk management strategy, startups can protect themselves from legal pitfalls while building trust with customers, investors, and regulators.

This proactive approach not only mitigates risks but can also become a competitive advantage in today’s highly regulated business environment.

12. Effective Stakeholder Communication

In the volatile world of startups, clear and consistent communication with stakeholders is a critical component of risk management.

Effective communication helps build trust, manage expectations, and ensure all parties are aligned on goals and potential challenges.

Importance of Regular Updates to Stakeholders

Regular communication with stakeholders serves several crucial purposes in risk management:

- Transparency: Keeps all parties informed about the company’s progress, challenges, and risk mitigation efforts.

- Trust Building: Demonstrates accountability and builds confidence in the startup’s leadership.

- Early Problem Detection: Allows for early identification of potential issues through stakeholder feedback.

- Alignment: Ensures all stakeholders are on the same page regarding the company’s direction and risk appetite.

According to a Project Management Institute study, organizations that communicate effectively complete 80% of their projects successfully, compared to only 52% for those with poor communication.

This statistic underscores the critical role of communication in project and risk management.

Building a Transparent Communication Strategy

To develop an effective stakeholder communication strategy:

- Identify Key Stakeholders: This may include investors, employees, customers, partners, and regulators.

- Tailor Communication: Customize your message and medium based on each stakeholder group’s needs and preferences.

- Establish Regular Reporting Cadence: Set up a schedule for updates (e.g., monthly newsletters, quarterly reports).

- Use Multiple Channels: Leverage various communication tools such as emails, video calls, in-person meetings, and project management software.

- Be Proactive: Don’t wait for stakeholders to ask for updates. Anticipate their information needs and provide updates preemptively.

Best Practices for Communicating with Different Stakeholder Groups

| Stakeholder Group | Communication Best Practices |

| Investors | Regular financial updatesMilestone achievementsRisk assessments and mitigation strategies |

| Employees | Company-wide meetingsInternal newslettersAn open-door policy for concerns |

| Customers | Product updatesService improvementsTransparent handling of issues |

| Partners | Joint project status reportsShared risk assessmentsRegular strategy alignment meetings |

| Regulators | Compliance reportsProactive disclosure of potential issuesTimely responses to inquiries |

Handling Crisis Communication

In times of crisis or when communicating about significant risks:

- Be Timely: Address issues promptly to prevent the spread of misinformation.

- Be Honest: Acknowledge the problem and provide accurate information about its impact.

- Outline Action Plans: Clearly communicate the steps being taken to address the issue.

- Provide Regular Updates: Keep stakeholders informed as the situation evolves.

By prioritizing effective stakeholder communication, startups can create a supportive ecosystem that’s better equipped to navigate risks and challenges.

This open dialogue not only helps in managing current risks but also in building resilience for future uncertainties.

13. Market Research and Competitor Analysis

Effective market research and competitor analysis are crucial components of risk management for startups.

These strategies help identify potential threats and opportunities in the business landscape, allowing entrepreneurs to make informed decisions and mitigate risks proactively.

Conducting Market Research to Anticipate Risks

Market research is essential for understanding your target audience, industry trends, and potential challenges.

Here’s how to leverage it for risk management:

- Identify Market Trends: Stay ahead of industry shifts by regularly analyzing market reports and forecasts. According to a study by CB Insights, 42% of startups fail due to a lack of market need. By staying informed about market trends, you can adjust your strategies and reduce the risk of product-market misfit.

- Analyze Customer Behavior: Use surveys, focus groups, and analytics tools to gather insights about your target audience. Understanding customer preferences and pain points helps you anticipate changes in demand and adapt your offerings accordingly.

- Monitor Regulatory Changes: Keep an eye on upcoming regulations that might affect your industry. For example, the implementation of GDPR in 2018 significantly impacted how businesses handle customer data. Staying informed about regulatory changes allows you to prepare and avoid compliance risks.

Analyzing Competitor Moves and Industry Trends

Competitor analysis is crucial for identifying potential risks and opportunities in your market.

Here’s how to use competitor insights to refine your risk strategies:

- Track Competitor Strategies: Regularly monitor your competitors’ product launches, marketing campaigns, and partnerships. This can help you identify potential threats to your market share and opportunities for differentiation.

- Benchmark Performance: Compare your key performance indicators (KPIs) with those of your competitors. This can help you identify areas where you’re lagging behind and potential risks to your competitive position.

- Identify Market Gaps: Look for unmet needs in the market that your competitors aren’t addressing. These gaps can represent opportunities for growth and risk mitigation through diversification.

- Learn from Competitor Mistakes: Pay attention to the challenges and failures of your competitors. According to a report by Failory, 90% of startups fail within their first five years. By learning from others’ mistakes, you can avoid similar pitfalls and strengthen your risk management strategy.

Leveraging Technology for Market Intelligence

Modern startups can use AI and big data analytics tools to gain deeper insights into market trends and competitor activities.

For example, tools like Crayon or Kompyte can automate competitor tracking and provide real-time alerts on market changes.

By integrating market research and competitor analysis into your risk management process, you’ll be better equipped to navigate the dynamic startup landscape and make data-driven decisions that minimize risks and maximize opportunities for success.

14. Scenario Analysis and Stress Testing

Scenario analysis and stress testing are powerful tools that startups can use to anticipate potential risks and prepare for various future outcomes.

These techniques help entrepreneurs make more informed decisions and develop robust risk management strategies.

Creating Different Risk Scenarios

Scenario analysis involves developing multiple plausible future scenarios and evaluating how your startup would fare in each.

Here’s how to create effective risk scenarios:

- Identify Key Variables: Determine the critical factors that could impact your business, such as market demand, competition, regulatory changes, or economic conditions.

- Develop Plausible Scenarios: Create 3-5 distinct scenarios ranging from best-case to worst-case. For example:

- Optimistic: Rapid market growth and high customer adoption.

- Realistic: Moderate growth with some challenges.

- Pessimistic: Slow growth, intense competition, and regulatory hurdles.

- Assess Impact: For each scenario, evaluate how it would affect your startup’s key performance indicators (KPIs), such as revenue, user acquisition, or burn rate.

- Develop Response Strategies: Create contingency plans for each scenario, outlining specific actions to mitigate risks or capitalize on opportunities.

Conducting Stress Tests on Business Plans

Stress testing involves subjecting your business plan to extreme conditions to identify vulnerabilities and assess your startup’s resilience.

Here’s how to conduct effective stress tests:

- Identify Key Risks: Determine the most significant risks facing your startup. For example, a fintech startup might focus on risks like cybersecurity breaches or sudden regulatory changes.

- Define Stress Scenarios: Create extreme but plausible scenarios that would put significant strain on your business. For instance:

- A 50% drop in revenue.

- Loss of a key client or partner.

- A major data breach.

- Analyze Financial Impact: Use financial modeling to assess how each stress scenario would affect your cash flow, profitability, and runway.

- Evaluate Operational Resilience: Assess how your operations, team, and technology stack would handle each stress scenario.

- Develop Mitigation Strategies: Based on the results, create specific action plans to address vulnerabilities and improve your startup’s resilience.

Benefits of Scenario Analysis and Stress Testing

- Improved Decision-Making: By considering multiple future outcomes, you can make more informed strategic decisions.

- Enhanced Preparedness: Developing response strategies for various scenarios helps your startup react quickly to changing conditions.

- Increased Stakeholder Confidence: Demonstrating thorough risk analysis can boost investor and partner confidence in your startup.

- Identification of Hidden Opportunities: Scenario analysis can uncover potential opportunities that might arise from changing market conditions.

By incorporating scenario analysis and stress testing into your risk management process, you’ll be better equipped to navigate uncertainties and build a more resilient startup.

15. Technological Risk Management

In today’s digital-first business environment, managing technological risks is crucial for startup success.

From cybersecurity threats to the risk of technological obsolescence, startups must be proactive in addressing these challenges.

Protecting Against Cybersecurity Threats

Cybersecurity is a critical concern for startups, as a single breach can lead to significant financial losses and reputational damage.

Here are some strategies to mitigate cybersecurity risks:

- Implement Strong Data Protection Measures:

- Use encryption for sensitive data both in transit and at rest.

- Implement multi-factor authentication (MFA) for all user accounts.

- Regularly back up data and test recovery procedures.

- Conduct Regular Security Audits:

- Perform penetration testing to identify vulnerabilities in your systems.

- Use tools like Nessus for automated vulnerability scanning.

- Educate Employees:

- Provide regular cybersecurity training to all team members.

- Implement a clear security policy and ensure all employees understand it.

- Stay Updated with Security Patches:

- Regularly update all software and systems to protect against known vulnerabilities.

- Use automated patch management tools to streamline this process.

- Develop an Incident Response Plan:

- Create a clear protocol for responding to security breaches.

- Conduct regular drills to ensure your team is prepared to act quickly in case of an incident.

Avoiding Technological Obsolescence

In the fast-paced world of technology, staying current is crucial for maintaining a competitive edge.

Here’s how startups can mitigate the risk of technological obsolescence:

- Continuous Learning and Adaptation:

- Encourage a culture of continuous learning within your team.

- Allocate resources for training and skill development in emerging technologies.

- Flexible Technology Stack:

- Choose technologies and platforms that are scalable and adaptable.

- Consider using microservices architecture for easier updates and modifications.

- Regular Technology Audits:

- Periodically assess your technology stack against industry standards and emerging trends.

- Use tools like Technology Radar to stay informed about technology trends.

- Strategic Partnerships:

- Collaborate with technology vendors and research institutions to stay at the forefront of innovation.

- Consider joining industry consortiums or innovation hubs.

- Invest in Research and Development: Allocate a portion of your budget to R&D to explore new technologies and their potential applications for your business.

Leveraging AI for Risk Management

Artificial Intelligence (AI) and Machine Learning (ML) can be powerful tools for managing technological risks.

Here are some ways startups can leverage AI:

- Predictive Maintenance: Use AI to predict when systems or equipment are likely to fail, allowing for proactive maintenance.

- Anomaly Detection: Implement ML algorithms to detect unusual patterns in system behavior that might indicate a security breach or performance issue.

- Automated Threat Intelligence: Use AI-powered tools to gather and analyze threat intelligence, helping you stay ahead of potential cybersecurity risks.

- Risk Forecasting: Leverage AI to analyze historical data and predict future technological risks, allowing for more informed decision-making.

By implementing these technological risk management strategies, startups can build a more secure and resilient technology foundation, positioning themselves for long-term success in the digital economy.

Balancing Risk-Taking with Risk Management

In the dynamic world of startups, finding the sweet spot between bold risk-taking and prudent risk management is crucial for sustainable growth.

While risk-taking is often seen as a hallmark of entrepreneurship, it must be tempered with strategic risk management to ensure long-term success.

The Role of Risk-Taking in Startup Growth

Risk-taking is an essential ingredient in the recipe for startup success.

It’s what drives innovation, market disruption, and rapid growth.

Consider these key points:

- Innovation catalyst: Taking calculated risks often leads to groundbreaking products or services. For example, when Airbnb launched in 2008, the idea of strangers staying in each other’s homes was considered risky.

- Market differentiation: Bold moves can set a startup apart from competitors. Tesla’s risk in focusing solely on electric vehicles in its early days has now positioned it as a leader in the automotive industry.

- Rapid scaling: Embracing risk can lead to faster growth. Uber’s aggressive expansion strategy, despite regulatory challenges, helped it become a global transportation giant.

However, unchecked risk-taking can lead to disaster.

A study by CB Insights found that 35% of startups fail due to running out of cash or failing to raise new capital, often a result of poor risk management.

Strategies for Balancing Risk and Reward

- Adopt a portfolio approach to risk:

- Diversify your risk across different projects or initiatives.

- Allocate resources based on potential impact and likelihood of success.

- Use data-driven decision-making:

- Leverage analytics and market research to inform risk decisions.

- Implement A/B testing for new features or strategies to minimize risk.

- Set clear risk thresholds:

- Define what level of risk is acceptable for different aspects of your business.

- Regularly review and adjust these thresholds as your startup grows.

- Cultivate a culture of calculated risk-taking:

- Encourage team members to propose innovative ideas.

- Implement a structured process for evaluating and implementing new initiatives.

- Learn from failures quickly:

- Adopt a “fail fast” mentality to minimize losses from unsuccessful ventures.

- Conduct thorough post-mortems to extract valuable lessons from failures.

Remember, the goal isn’t to eliminate all risks but to take smart, calculated risks that align with your startup’s goals and capabilities.

By striking the right balance between risk-taking and risk management, startups can navigate the treacherous waters of entrepreneurship and emerge as successful, innovative companies that shape the future of their industries.

Emerging Risks in the Startup Ecosystem

As the business landscape evolves rapidly, startups face a host of new challenges that weren’t on the radar even a few years ago.

Staying ahead of these emerging risks is crucial for startup success in today’s dynamic environment.

New Risks Facing Startups Today

- AI Ethics and Governance: As AI becomes more prevalent, startups must navigate complex ethical considerations and potential regulatory frameworks.

- Climate Change Impact:

- Startups need to consider how climate change might affect their supply chains, operations, and market demand.

- Physical risks (like extreme weather events) and transition risks (such as changing regulations) can significantly impact business models.

- Cybersecurity Threats: With increasing digitalization, startups are more vulnerable to sophisticated cyber-attacks.

- Data Privacy Regulations:

- Evolving data protection laws like GDPR and CCPA create compliance challenges for startups handling customer data.

- Non-compliance can result in hefty fines and loss of consumer trust.

- Geopolitical Instability:

- Global events can disrupt supply chains, alter market conditions, and affect international expansion plans.

- Startups need to be prepared for sudden changes in trade policies or regional conflicts.

- Talent Wars in Remote Work Era:

- With the rise of remote work, startups now compete globally for talent, increasing hiring costs and retention challenges.

- According to a Gartner survey, 48% of employees will likely work remotely at least part of the time post-COVID-19.

Staying Ahead of Evolving Risks

- Continuous Environmental Scanning:

- Regularly monitor industry trends, regulatory changes, and technological advancements.

- Use tools like Google Alerts, industry publications, and expert networks to stay informed.

- Scenario Planning:

- Develop multiple future scenarios and plan responses for each.

- Use techniques like the Delphi method or cross-impact analysis to improve scenario accuracy.

- Agile Risk Management:

- Implement flexible risk management processes that can quickly adapt to new threats.

- Consider using agile methodology for risk management, allowing for rapid iterations and adjustments.

- Collaborative Risk Intelligence:

- Engage with industry peers, attend conferences, and participate in startup ecosystems to share risk insights.

- Consider joining industry associations that provide risk management resources and networking opportunities.

- Invest in Emerging Risk Expertise:

- Build a diverse advisory board with expertise in areas like AI ethics, climate science, or cybersecurity.

- Allocate resources for ongoing team training on emerging risks and mitigation strategies.

- Leverage Technology for Risk Management:

- Explore AI and machine learning tools for predictive risk analysis.

- Implement robust project management tools that incorporate risk tracking and mitigation features.

By staying vigilant and proactive in addressing these emerging risks, startups can not only protect themselves but also turn potential threats into competitive advantages.

Effective risk management is not just a defensive strategy, it’s a powerful tool for startup growth and sustainability.

By implementing the 15 risk management strategies outlined in this article, startups can navigate the choppy waters of entrepreneurship with greater confidence and resilience.

Each of these strategies plays a crucial role in building a comprehensive risk management framework tailored to the unique challenges faced by startups.

People Also Asked

1. Why is risk management crucial for startups?

Risk management is crucial for startups because it helps identify potential threats, minimize their impact, and seize opportunities. Effective risk management can prevent financial losses, protect reputation, and ensure sustainable growth.

For example, a startup that anticipates market shifts through risk analysis can pivot its strategy before competitors, gaining a significant advantage.

2. How can a risk matrix help prioritize risk mitigation efforts?

A risk matrix helps prioritize mitigation efforts by visually representing risks based on their likelihood and potential impact. It allows startups to focus resources on high-priority risks first.

For instance, a risk with high likelihood and severe impact would be placed in the top-right quadrant of the matrix, signaling immediate attention is needed.

3. What strategies can startups employ to mitigate risks?

Startups can mitigate risks through various strategies, including:

- Developing contingency plans.

- Diversifying products or markets.

- Implementing robust cybersecurity measures.

- Building a strong team with diverse skills.

- Maintaining adequate cash reserves.

For example, a tech startup might mitigate the risk of data breaches by investing in advanced encryption technology and regular security audits.

4. How can startups stay ahead of emerging risks in a rapidly evolving landscape?

Startups can stay ahead of emerging risks by:

- Continuously monitoring industry trends and regulatory changes.

- Engaging in scenario planning exercises.

- Fostering a culture of innovation and adaptability.

- Leveraging AI and big data for predictive analysis.

- Participating in industry forums and startup ecosystems to share insights.

For instance, a fintech startup might use AI-powered tools to predict and prepare for potential regulatory changes in the cryptocurrency market.

5. How can effective stakeholder communication contribute to risk management?

Effective stakeholder communication contributes to risk management by:

- Building trust and transparency.

- Ensuring alignment on risk tolerance and mitigation strategies.

- Facilitating early detection of potential issues.

- Mobilizing support for risk management initiatives.

For example, regularly updating investors on potential risks and mitigation efforts can help maintain their confidence during challenging times and potentially secure additional funding if needed.